At Baker Tilly, we believe that knowledge should be shared. Well-informed decision-making is a practice we live and share, which is why we invite you to discover the exciting world of M&A.

Integration process: 100-day plan

In this HowTo on the integration process and the 100-day plan. From Baker Tilly Goblal Deal Advisory we have asked ourselves 3 general questions about this aspect to help those companies that want to tto have a reference model of how to make a 100 day plan, although as we say in the text, each company is a world of its own and each integration process is different, so it is a mistake to deal with this subject in a very specific way and give a template, since it can only be approached in a generic way and seeing what are some common elements.

What is the 100-day plan?

It is usually a document that tries to set out the challenges and objectives to be achieved on a specific issue in the next 100 days. The creation of such a plan can help us to understand the values and culture of the company or those that are deeper than we may be aware of at first glance. In a way, it also serves as a way to hold ourselves accountable or to see how we are doing. It is as if it were the first exam we want to set ourselves.

Just look at politics and see how many politicians talk about 100-day plans and the changes they want to bring about, it is the beginning of a legislature and it carries with it a 100-day plan.

From Baker Tilly Global Deal Advisory wants to try to establish in a generic way a 100-day plan proposing some issues to be addressed during this 100-day plan. We say in a generic way because each company is a world and each integration is another world, but there are some common issues that we want to propose.

When can we use this mehtod or when can it work for us?

The 100-day plan approach can work quite well for smaller deals, for transactions where integration requirements are minimal, and for deals where there is minimal overlap of operations and administrative functions. Why do we want to emphasise this point? Because typically a deal will require a higher degree of consolidation and this requires a more intensive approach to process planning. This is why the 100-day plan will sometimes serve as a supplement rather than the sole organisational element.

On the other hand, there are some companies or some integration processes that already during the acquisition process, a small "100-day plan" is considered, since in a very general way they can consider how they would develop the strategy.

What should we address in the 100-day plan?

Firstly, we should not panic if, after an acquisition process, some people have left the organization or simply the level of commitment has decreased.. What has probably happened is that the employee has focused on "mine". Therefore, the first point to be addressed during the 100-day plan is how to awaken the motivation of those who have stayed or of this new team that we will form.

The key to this point, and to the first few weeks, will be to move from that "my thing"which we have previously commented on "our thing". In other words, the challenges and concerns are no longer individual after the indecisive period that may have passed, but we now focus on the common objectives of the company and that if one has stayed in the boat it is to row as one more. To this end it is key to understand the factors that motivate these individuals and/or groups and to develop a plan within these 100 days to satisfy their motivations..

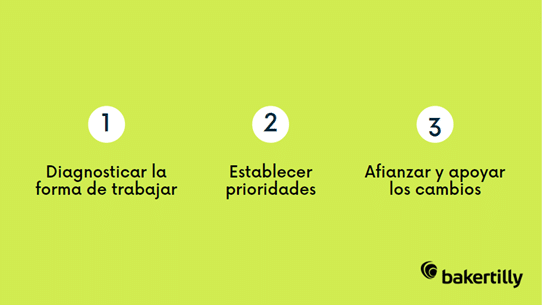

Secondly, cultural factors and organisational alignment are very important for the success of a merger or acquisition. For this, we will look at 3 key steps to maintain a good company culture after a merger and see which factors help to foster a good new company culture.

Step 1: Diagnosing the way of working

It is important to see what the most differentiating values of both companies are and to see what makes them different from the rest. This will help to understand the most intrinsic value of the company.

This is not only qualitative and instinct-driven research by company leaders, but there must be quantitative research behind it. The most common way to conduct this part of the research is to start with interviews or focus groups with managers and secondly to conduct surveys at a more macro level. And then after these two actions start to draw conclusions.

Step 2: Setting priorities

After acquiring an understanding of the cultures, leaders can begin to define what the priorities are. They should start with the cultural aspects that may have helped at the time of the negotiation, as these are points that they have in common or that have worked previously.

Step 3: Entrenching and supporting change

Once the initiatives and models have been identified, they can be put into practice for day-to-day routines. Here it is very important that the message cascades down to all levels of the company.

Thirdly, having seen the differences we face, the team leading this new venture and the company's next steps must focus on the familiar cultural integration. It is closely related to the second step, but this would be more long-term as it is consolidated towards the end of the 100-day plan.

We must start from the premise that the corporate culture of a company is not isolated elements, but elements related to each other in the form of a mosaic, so let us imagine the mosaic or the work we must dedicate to create the same mosaic of two different companies.

The primary reason for addressing the cultural integration issue should be to accelerate and maintain the desired strategy for the new company's organization. Too often, senior leaders get stuck during integration because they do not understand how to make the strategy and major changes required for the managers and employees of the new company.

So, what is the solution? Well, although it may seem obvious, the solution is to ask. This is the part of the process where we must gather more information from both parties, especially by asking, whether through qualitative interviews, focus groups or simply in a relaxed and informative way by asking questions.

In any case, if this article has generated interest in the acquiring companies or if you have any doubts, you can go to our website and find out more about the process itself and its characteristics.

Request for information

If you want to buy or sell a company, or need more information about our services, do not hesitate to contact us through the form.

Or if you prefer, call us at: