This post analyzes the values of 20 Advertising companies listed on different European stock exchanges. The Advertising companies sector is a very large sector, with a remarkable consolidation, but with a great future due to the forced integration of technology in the sector, giving rise to new specialized companies. In this article, we will show the main variables to be taken into account for the valuation of companies and, on the other hand, the analysis of the valuation by multiples.

Analysis of the main variables

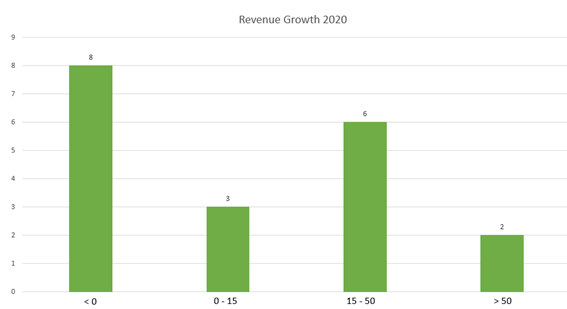

Revenue growth

The average growth rate is 14% and the median is very close (10%), which indicates the uniformity of the data. Despite this, there is a maximum of 96% growth compared to last year, and a minimum of -39%. The maximum belongs to Mirriad, a leading UK content advertising company with unique AI and data processing technology.

"advertising companies", such as those in AdTech, which have withstood the pandemic best. A report is available here link.

The average growth rate is 14% and the median is very close (10%), which indicates the uniformity of the data. Despite this, there is a maximum of 96% growth compared to last year, and a minimum of -39%. The maximum belongs to Mirriad, a leading UK content advertising company with unique AI and data processing technology.

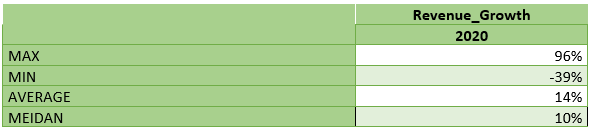

Profitability

The gross margin shows that the companies are mostly profitable, with an average of just over 50%. Despite this, they are not as high gross margin values as other sectors, Cloud Computing, for example. In other words, these companies earn less revenue per sale made than other companies, such as software technology companies, for example, without taking away from the fact that advertising companies are attractive.

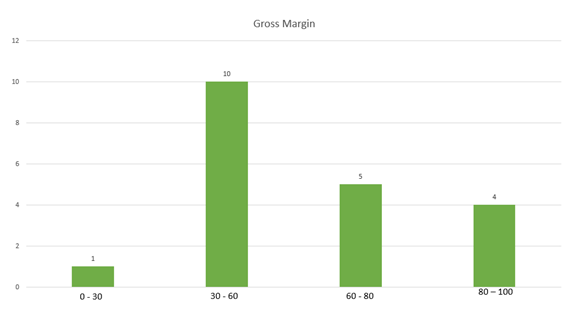

In terms of EBITDA margin (EBITDA/Revenues), it shows that more than half of companies Advertising analysed have positive EBITDA, thus having a positive margin. The average does not have a significant value, given that there is a outlayer negative and very low, belonging to the aforementioned Mirriad. This is due to the fact that the English company, despite having such a high growth, revenues are small (2.93M$) and its EBITDA is negative and very low (-11.3M$).

The company with the highest EBITDA margin is the well-known Tencent, a Chinese company that offers Internet, mobile telephony, telecommunications and online advertising value-added services. Its margin is 60%, with revenues of $60 billion and EBITDA of more than $36 billion.

Valuation analysis by multiples

EV/Revenues vs EV/EBITDA

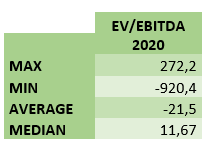

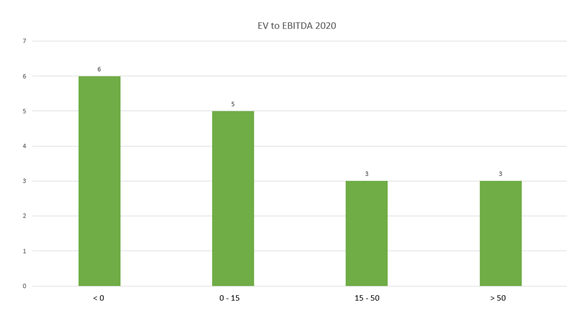

In general, the EV/EBITDA multiple is usually more meaningful than the EV/revenue multiple because it shows less dispersion. Therefore, we will use this ratio. While it is true that the mean of the ratio is negative, at (-21.56), the median has a positive value of 11.67. This is due to an outlayer belonging to the Israeli company Fiverr, a freelance services platform specializing in the fields of gigs, online marketplace, services, small business, freelance and logo designs.

As can be seen in the graph, most companies have a positive ratio of at least double digits (9 companies to be exact). The company with the highest ratio, that maximum of 272.2, is Magnite, an American digital marketing company.

Annual Valuation Performance by multiples 2020 vs 2019

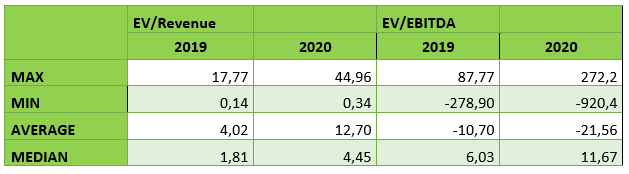

In this table we can also observe the ratio of the value of the company with respect to revenues. In this case, growth is observed in all directions, reaching a ratio value of 12.70 on average.

On the other hand, with the EBITDA ratio, we observe that the average decreases, remaining at a negative value, due to the existing outlayer present in the minimum (-920.4). On the other hand, the median, which is more significant in this case, increases in value, almost doubling that of last year.

Conclusions

Business growthAdvertising

Advertising companies have decreased in the last year mainly due to the pandemic, although it is true that the previous year they had grown considerably, so maintaining those numbers was not easy.

Benefi

The profit of the studied companies, as we have seen, has decreased. Gross margins are not as large as in other sectors, even though their average is somewhat higher than 50%, which is not a negligible value.

EV/EBITDA and EV/Revenue performance

Growth in both ratios, with the significant values of both ratios in 2020 being close to 12.