In this post we will describe the most relevant FinTech companies in a sector that is becoming more and more active, as can be seen in the Investment Report 2021 developed by Baker Tilly analysts, experts in the sector. Throughout this article, we will analyse the top 3 most relevant FinTech companies according to 3 criteria: the range of revenues, the number of mergers and acquisitions and the funding received (data obtained from Crunchbase).

By Income Range

Du Xiaoman Financial

The most relevant among all FinTech companies according to their revenue rank is the Chinese company Du Xiaoman Financialbelonging to the Baidu group, the Chinese search engine. Du Xiaoman is the FinTech arm of Baidu. This FinTech offers investment services or loans through its online platform and thanks to the use of Artificial Intelligence, it offers very reliable products. This company has more than 10 billion dollars.

Mahindra Finance

Second, according to Crunchbase, India's Mahindra Finance also has more than $10 billion in revenues. This company focuses on the rural and semi-urban world by offering financing for the purchase of utility vehicles, tractors, cars, commercial vehicles, etc., although it also has personal and mortgage loans.

Klarna

In third place, one of the best known FinTech companies is Klarna. This Swedish company offers payment solutions through its e-commerce platform. It helps you to manage purchases, payment reminders, numerous payment methods, etc. Karna has revenues of just under 10 billion dollars.

Depending on the number of mergers and acquisitions

Nordic Capital

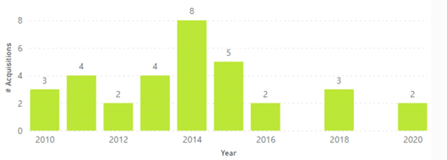

First, there is Danish Private Equity, Nordic Capital. This PE, founded in 1989 and immersed in the FinTech sector for the last 10 years, has realised 65 mergers and acquisitions over the course of their lifetime. Of this total, around 30% have done so in the last 3 years. In the last mergers and acquisitionsNordic Capital is focusing on software companies such as Duco, BearingPoint RegTech or wealth management companies such as Max Matthiessen or healthcare companies such as Advanz Pharma or SpaMedica. Most of the companies acquired were Swedish, followed by Danish companies (24 and 8 respectively).

mergers and acquisitions by Nordic Capital, one of the most relevant Fintech companies in the sector. It was in 2012 when it carried out more mergers and acquisitions, 9.

" class="wp-image-52171″ width="567″ height="233″/>

mergers and acquisitions by Nordic Capital, one of the most relevant Fintech companies in the sector. It was in 2012 when it carried out more mergers and acquisitions, 9.

" class="wp-image-52171″ width="567″ height="233″/>Fiserv

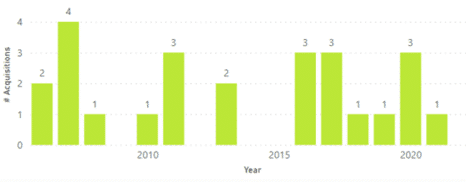

In second place is Fiserv, with 36 mergers and acquisitions on its back. This US FinTech, which is more focused on payment systems and processing, has made 7 mergers and acquisitions in the last three years, having completed 2 so far this year 2021. Most of the companies acquired are dedicated to software management for financial companies, such as Dovetail. Companies that offer different payment platforms, such as Pineapple Payments, are also very present. Almost all of the mergers and acquisitions have been to US companies with the exception of two UK companies (Dovetail and Monitise), one Dutch company (NetEconomy) and one New Zealand company (Mobile Commerce).

Rakuten

Finally, in third place is Rakuten. This provider of FinTech products and services, e-commerce, credit and payments has mainly made 35% of the total amount of the total. mergers and acquisitions. This year, 2021, it has not yet completed any. Most of the acquired companies are in the e-commerce sector. The preferred place of mergers and acquisitions for Rakuten is Japan, where 19 of the 35 acquisitions have taken place. It is followed by the United States (9) and France (2).

Depending on the funding received

China Ant Group

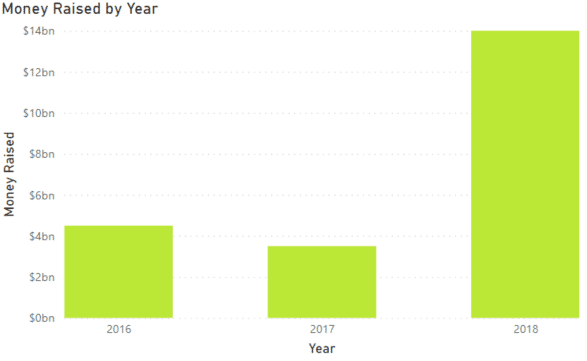

In first place is the Chinese company Ant Group. This company has only made 5 rounds of financing, of which we do not know the amount raised in 2 of them, the first in 2015 and the last one this January. Therefore, the sum of the known amounts is 22 billion dollars, which proclaims it as the Top 1 company according to the financing received.

Taulia

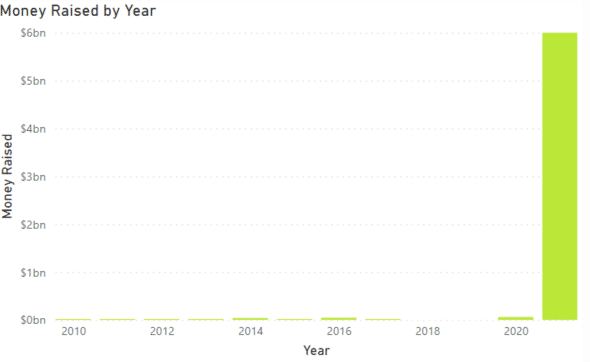

Taulia is at our number 2, having received just over $6.2 billion in funding in its lifetime. Until this year, it had raised 11 rounds, none of which exceeded $100 million. Despite this, on 10 March this year it raised a $6 billion round, funding that has helped its platform providers linked to Greensill Capital's clients.

Robinhood

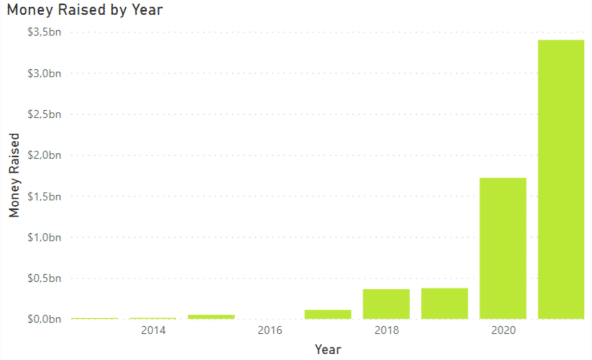

In third and last place in this Top 3 is Robinhood. This American online broker has raised just over $6 billion through 29 rounds of financing. The last two, held in 2021, have been the most valuable, one of them reaching $1 billion and the other $2.4 billion.