At Baker Tilly, we believe that knowledge should be shared. Well-informed decision-making is a practice we live and share, which is why we invite you to discover the exciting world of M&A.

The 10 stages of a company's sales process

The key to a successful sales process

The process of selling a company is critical in the professional life of every entrepreneur. The main objective is to maximise compensation for a lifetime's work by obtaining the best price and ensuring the continuity of the company and its team.

The sale of a company is a complex and high-impact process. At Baker Tilly Tech M&A AdvisoryWith each transaction, our team specialised in M&A improves its capabilities to make selling a company easier and easier. Our work is based on the following pillars:

- A methodology designed in 10 steps We have a well-defined set of guidelines where we gather all the experience accumulated by our professionals and the best practices.

- A well-crafted multidisciplinary team led by a specialist senior professional in negotiation of the sale of technology companies

- A knowledge base that grows with each transaction in the form of templates, databases, frameworks, best practice sheets, etc.

10 steps in the process of selling a company

The 10 stages of a successful sales process

1. Strategy

The success of any process is a good preparation. To this end:

- Am I clear about the main objective of selling my business?

- What other alternatives should I consider?

- What minimum price do I set in order to be able to close the transaction?

- How and when do I involve the management team in the process?

- How long can the process take?

Good planning is key to obtaining a good assessment and to reducing the time of the process.

2. Documentation

Be prepared in advance for any possible questions from the potential buyer. Typical questions are:

- Who is the key team?

- What is the extent of the company's bonding or retention scheme?

- What are the main competitors?

- How does our company differentiate itself?

- Why does the customer buy from you?

- How do you protect the intellectual property of products?

3. Financial Information and Valuation

Consistent and easy to understand financial information reflects professionalism and builds buyer confidence. Aspects to take into account include, among others:

- Should I make adjustments to the official information?

- Should I capitalise on the internal cost of product development?

- How does my financial data compare with my competitors?

- Are the projections credible?

- Should I be optimistic or cautious in my projections?

- Does the investor look more to the past or to the future?

Be careful because the price may include a variable part that is often linked to the projections presented to the investor.

4. Identifying potential investors

- What kind of investor might be interested in my company?

- What is the difference between a financial investor and a strategic investor?

- Which of them might be willing to pay a better price?

- How can I understand the synergies to be gained from the acquisition?

- Who should I contact?

These are the kinds of questions that you should address before any contact with an investor.

5. Contacting potential counterparts

Contact the decision-maker and generate interest with a personalised message:

- What should the message be like for each potential?

- How do we manage confidentiality?

- Will other people influence the decision?

- What is your decision-making process like?

Extracting as much information as possible from the investor will provide you with tools for the next negotiation.

6. Investor qualification

The efficiency of the process depends mainly on negotiating with those investors who are genuinely interested in the acquisition.

- What is your interest in the purchase?

- What other transactions have you carried out?

- What is your financial capacity?

- What is the preferred type of operating structure?

- What is your integration process?

7. Negotiate, negotiate, negotiate

The secret is in the details.

- Which of the candidates should be negotiated with?

- Should an open, limited or bilateral auction be opened?

- Who should make the first offer?

- Who controls and drafts the LOI?

- What should the LOI include?

- Should exclusivity be accepted in the LOI?

- Who coordinates all those involved: lawyers, financiers, advisors, etc.?

This is the most important and complex phase; we put the process at stake in every detail.

8. Due Diligence

At this point many operations fall down.

- Do you have a tidy data room?

- What topics should be covered by the DD?

- Do I have to provide information on everything I am asked to provide?

- Must it be validated by a third party assessor or auditor?

- How does it relate to the final contract?

Good preparation from the beginning of the process avoids last-minute surprises.

9. Legal Closing

In the process of selling a company, the structure of the transaction is sometimes even more important than the price itself.

- What are the deadlines for the collection of the price?

- Does the price contain a variable part?

- Are there other forms of payment than cash?

- What guarantees must the seller give to the buyer?

- Do bonds or sureties have to be provided?

The aim is to minimise post-closure problems.

10. Integration

- What is the First 100 Days Plan?

- How are the synergies achieved calculated?

- How does reporting to the new owner start?

- Which team will be in charge of integration?

- How do we retain key staff?

- How do I manage cultural differences?

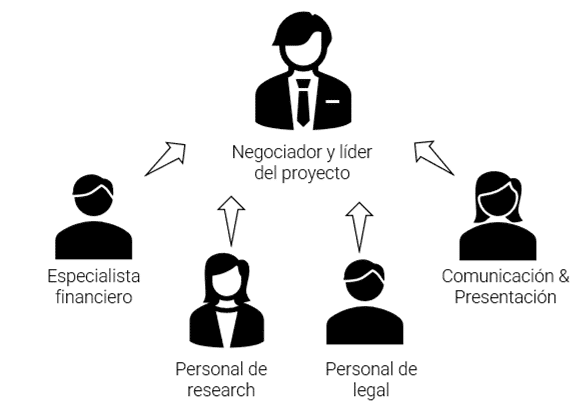

A multidisciplinary team led by a senior professional

In the process of selling a company, negotiation skills make all the difference. Therefore, the team in charge of the process must be led by a senior professional with extensive experience and whose daily responsibility is the sale and purchase of companies.

In order for such a professional to be focused on the negotiation, defining the most appropriate strategy and having the availability to attend to potential investors, he/she must be supported by a team of specialists in the following areas:

- Financial AnalystThe financial information: provides the ability to present financial information, both historical and projected, in an accurate and easy-to-understand manner.

- ResearchThe analysis can be enriched with information throughout the process. For example, by providing a competitive analysis of the company, information on potential investors in order to qualify them, etc.

- LegalThe LOI, SPA, SHA, etc.: provides the capacity to execute the agreements signed in the process.

- Communication & presentation: provides design and message tailoring capabilities to achieve the best impact on potential investors.

A knowledge base with more than 50 manuals and guides

We have a systematic approach to driving operational improvement in business sales processes using strategy manuals, best practice guides, databases and solid, proprietary expertise.

The development of this knowledge base has been led by Baker Tilly Global Deal Advisory with input from across Baker Tilly International.

Examples of some of these, grouped by stages are:

- Sales bookletCompetitive advantages, marketing plan, HR plan, competitive market analysis, etc.

- Financial information: projections, comparable transactions, DFC analysis, replacement cost, terminal value, etc.

- Risk analysis: revenue quality analysis, team analysis, business model analysis, product analysis and Intellectual Property, etc.

- InvestorsInvestor synergy analysis, investor response tracking report, Investor database (profiles and activity), etc.

- DDVirtual Data room, list of information, schedule of when and what information to provide, etc.

- LegalSPA, SHA, Employee agreement, non-competition, etc.

Request for information

If you want to buy or sell a company, or need more information about our services, do not hesitate to contact us through the form.

Or if you prefer, call us at: