Cellnex Telecom has completed the acquisition of Dutch infrastructure operator Alticom. The transaction, which has been closed for €133M, will result in the addition of 30 new towers in the Netherlands and will provide the company with €11.5M of EBITDA in 2018.

Cellnex buys Alticom for €133M

Cellnex, Europe's leading independent wireless infrastructure operator, has acquired the Dutch company Alticom. It is committed to its growth in the Netherlands as an independent telecommunications infrastructure operator. In this country, there is also a higher penetration of mobile broadband based on 4G.

Alticom has wireless transmission equipment for voice, data and audiovisual content, which will join the 758 sites that Cellnex Netherlands has had until now.

With this purchase, Cellnex is taking a step into the future of 5G, thanks to the ability of Alticom's equipment to accelerate data processing and increase the pace of traffic.

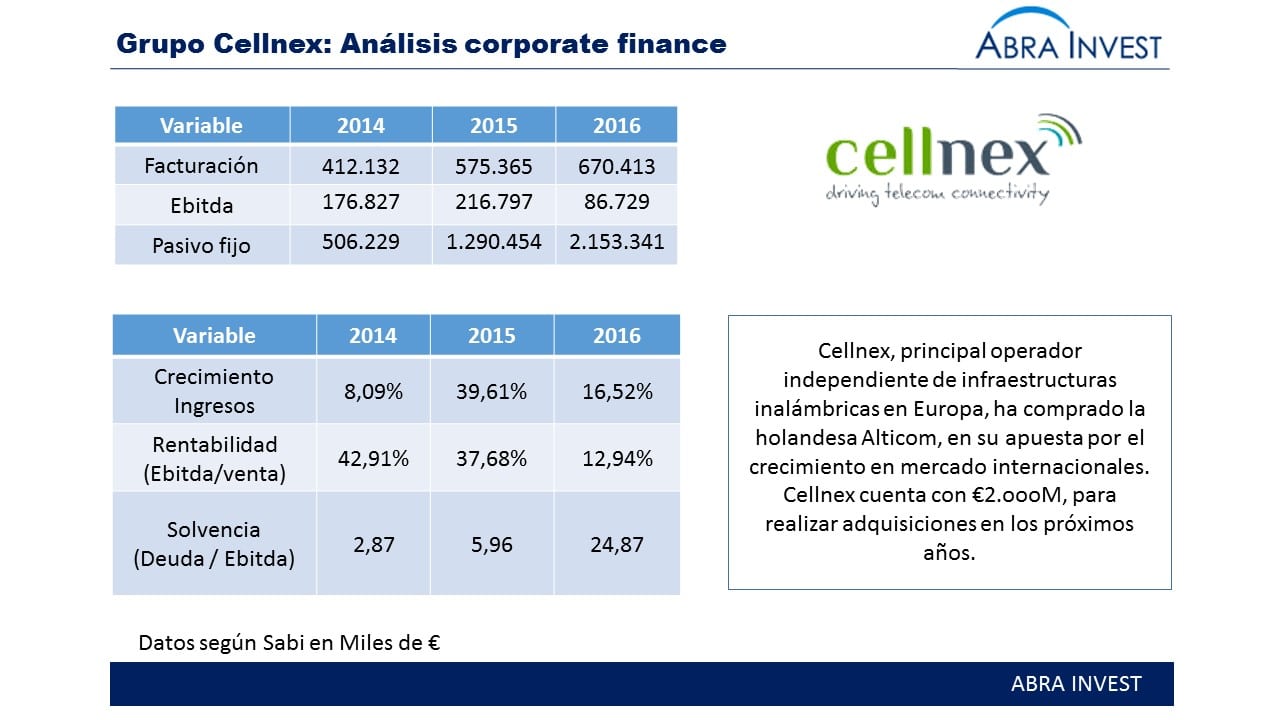

Cellnex corporate finance analysis

Cellnex is at a good time to realise mergers and acquisitions. Over the last 3 years, Cellnex has experienced annual revenue growth. In 2016 it grew by 39% and in 2016 it grew by 16%, reaching revenues of €670M. 36% of revenues and 33% of ebitda are generated outside the Spanish market (in 2014 95% of ebitda originated in Spain). Italy is the second most important market with €239m of revenues (34% of the total).

On the other hand, its operating profit grew by 23 % in the last year.

Su ratio de solvencia ha crecido con motivo de las mergers and acquisitions realizadas en el último año. Esta deuda tiene un coste medio de 2,6 % a cierre de 2016.

What other acquisitions has Cellnex made?

Aparte de la compra de Alticom, Cellnex ha realizado 2 mergers and acquisitions más en el último año, con el objetivo de expandirse por Europa. En el 2016 reforzó su apuesta por Italia comprando por €18,65M CommsConan operator that provides mobile broadband coverage solutions in large open or enclosed spaces characterised by a high concentration of users.

A few months later, it bought Shere Group, which allowed it to enter the UK and strengthen its position in the Netherlands. Shere Group owns 1,004 telephone towers, of which 540 units are spread across the UK, mainly in England and Wales.

Según informa la propia compañía, Cellnex dispone de €2000M para crecer mediante mergers and acquisitions. Además de los mercados en los que ya está presente, Cellnex planea expandirse en otros países de Europa Occidental como Alemania y Suiza con el objetivo de ampliar su perímetro.

Other posts that may interest you

If you are looking for investors, you want to buy or selling a companyplease contact us. Abra-Invest has a team of experts in each area at your disposal. Call +34 946424142 or fill in the contact form.