Tecnocom is a Spanish technology company listed on the Madrid Stock Exchange since 1987. In 2006, Tecnocom began a corporate expansion process with the aim of becoming a leader in the Spanish information technology market. It currently offers consultancy and outsourcing services for the development, maintenance and support of computer applications for different sectors such as banking, insurance, public administration and industry. Although it operates in the international market, 80% of its sales come from national clients.

The market trusts Tecnocom and its shares revalued by 197% up to October

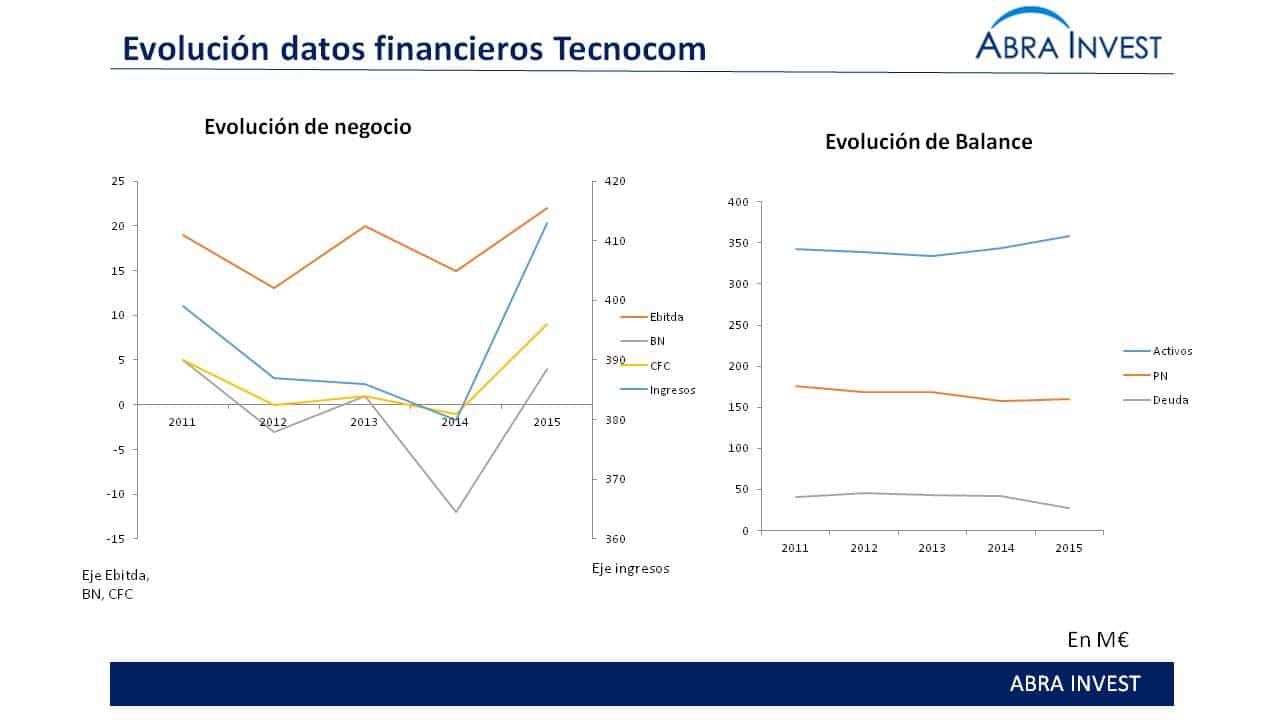

Tecnocom's revaluation is due to the good results obtained by the company in 2015, after a few years of stagnation caused by the crisis. During this period the company has maintained a more or less similar level of revenue, but its EBITDA and cash flow were quite affected. In 2015, this trend changed and there was a considerable increase in net profit from a loss of €12M to a profit of €4M.

In the same financial year 2015, the company also managed to reduce their capital investments by half, to €6M, while at the same time increasing its operating income (Ebitda) by 20.81 pct1Q to €20.6m.

Tecnocom in 2016

The 2016 figures are also looking good for the company. Revenues from January to September exceeded €300m, compared to just over €291m in the first nine months of 2015, a growth of 3.11GDP1Q, which rises to 4.41GDP1Q excluding currency effect.

In Spain, Tecnocom's revenues maintained the positive trend and increased by 6.31Tbp1T, with the Industry sector growing by 91Tbp1T, followed by Public Administrations with 81Tbp1T, Finance with 71Tbp1T and the Telco, Media and Energy sector with a growth of 31Tbp1T.

Tecnocom in the future

Projections for 2018 estimate sales growth of between 7.5% to 10% per annum. These figures are well above historical results.

Tecnocon has great confidence in the banking business, where it has been one of the country's major payment system providers for decades.

"Banking is undergoing a change of model that is leading to the emergence of new players. We have been working for many years on all the intelligence behind the card", adds the CEO. "We are a pure technology company with a lot of experience in banking and more and more doors are opening for us to collaborate. We have to find the future together, we need banks to do well and they need technology.

Outside the banking sector, they want to grow in distribution, energy and, to a lesser extent, public administration, where they have 8% of the business.

If you are looking for investorsor you want to buy or selling a companyPlease contact us on +34 946424142 or fill in the contact form.